TL;DR

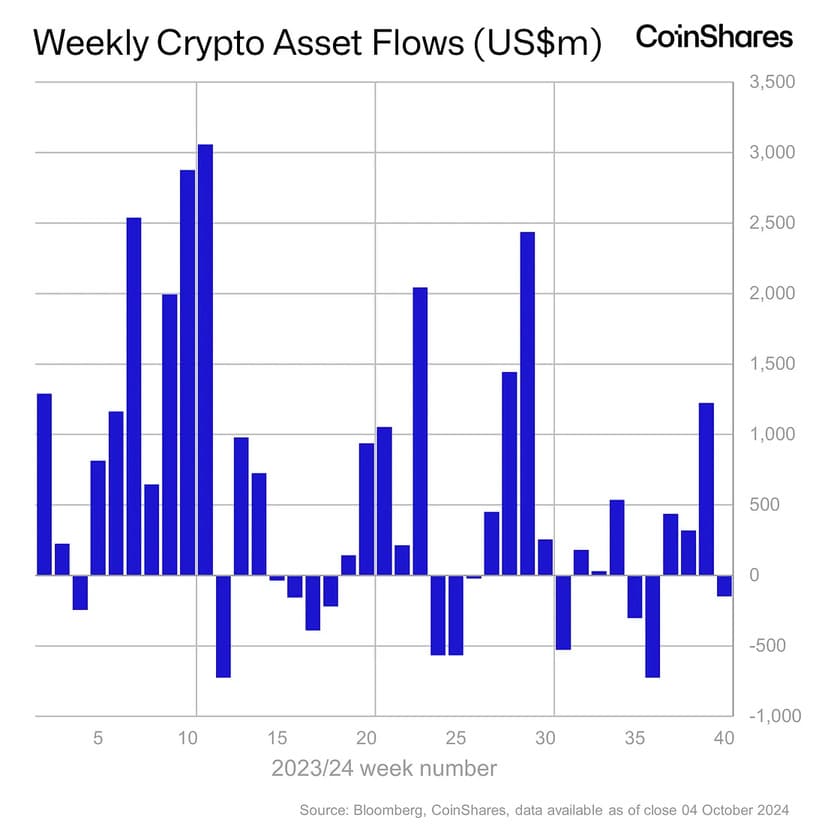

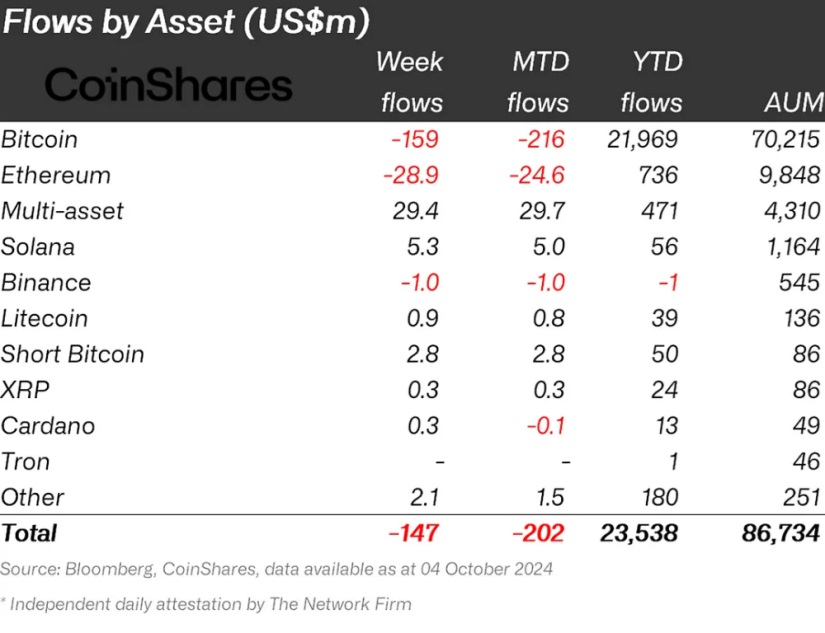

- Cryptocurrency investment products recorded divestments totaling $147 million last week.

- Bitcoin led the outflows with $159 million, while short Bitcoin products saw inflows of $2.8 million.

- Multi-asset products stood out with their sixteenth consecutive week of inflows, adding $29 million.

The past week brought a net capital outflow from cryptocurrency and other digital asset investment products, with a total of $147 million in divestments.

This phenomenon is attributed to the release of economic data that exceeded expectations, reducing the likelihood of significant interest rate cuts and affecting investor sentiment within the market.

Despite a marginal 15% increase in trading volumes, reaching $10 million in exchange-traded products (ETP), the broader market has shown a more moderate trend, with lower trading volumes in the crypto industry.

Tough Week for the Wealth Growth Insights

According to the report, Bitcoin (BTC) was the most affected asset, registering outflows of $159 million. However, products betting against BTC, known as “short-bitcoin,” recorded inflows worth $2.8 million. There is clear interest from certain investors to profit from potential further declines in the value of the most prominent cryptocurrency in the industry.

Meanwhile, Ethereum also faced a negative outlook, with outflows of $29 million. It is worth noting that ETH has shown significant difficulties in recovering from this situation, facing constant outflows. Despite its relevance in the industry and the broader market, enthusiasm toward Ethereum remains low compared to other periods of higher activity.

Strength of Multi-Asset Products

In contrast to these results, multi-asset investment products, which include a wide range of cryptocurrencies, continue to show signs of strength. These products recorded inflows of $29 million over the past week, marking their sixteenth consecutive week of positive flows, accumulating a total of $431 million since June. It seems that investors seeking diversification continue to prefer these types of products over focusing on individual assets.

Regionally, Canada and Switzerland showed an optimistic trend, with capital inflows of $43 million and $35 million, respectively. However, in markets like the United States, Germany, and Hong Kong, the outlook was different, with significant outflows of $209 million, $8.3 million, and $7.3 million.