TL;DR

- Ethena surpasses DAI and reaches a $6 billion market capitalization with its stablecoin USDe, standing out in the sector.

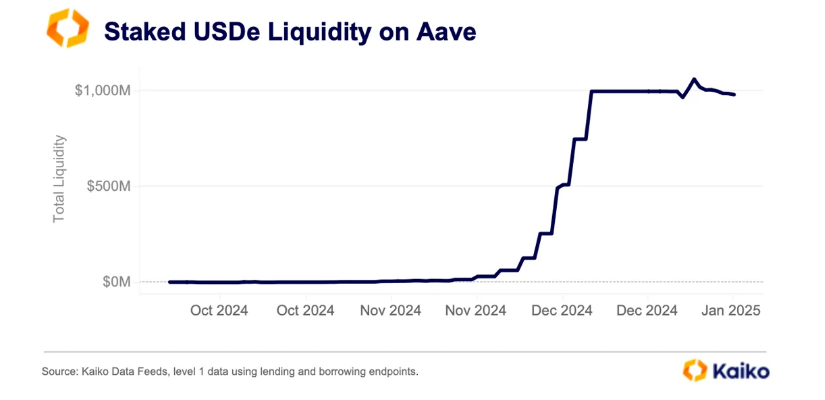

- The integration of sUSDe into Aave drives over $1 billion in inflows in just a few weeks, attracting large investors.

- Ethena launches USDtb, a stablecoin backed by U.S. government bonds and BlackRock, offering a more stable and reliable option.

The stablecoin market continues to evolve in 2024, and while giants like Tether and Circle adapt to stricter regulations, Ethena emerges as a key player thanks to its innovative approach, fast execution, scalability, and ability to adjust to new market conditions and demand. Ethena’s USDe stablecoin has reached a market capitalization of $6 billion since its public launch in February, surpassing DAI and establishing itself as the third-largest stablecoin by market capitalization, with a rapidly growing user base and institutional interest.

Accelerated Growth thanks to Its Integration into Aave

One of Ethena’s most notable milestones this year was the integration of the staked version of its stablecoin, sUSDe, into the Aave lending platform during the fourth quarter. This integration allowed users to use sUSDe as collateral, which boosted adoption and attracted over $1 billion in inflows in just a few weeks. Data reveals that more than half of these inflows came from just five main addresses, highlighting the interest of large investors in this stablecoin and solidifying its position in the DeFi space.

The success of USDe also boosted the price of Ethena’s governance token, ENA, which has returned to levels close to its initial launch, especially in a context where the price of Bitcoin surpassed $100,000.

Ethena did not stop there. The company recently launched USDtb, a stablecoin backed by U.S. government bonds through investments in BlackRock’s BUIDL, offering a more conventional and low-risk option for investors. While USDe uses delta-neutral hedging strategies to maintain its dollar peg, USDtb combines backing in traditional assets with a small portion in stablecoins to ensure quick redemptions and minimize volatility.

Ethena’s rapid innovation and adaptability have been crucial to its rise. While Maker fragments its liquidity with the launch of USDS, and Circle and Tether struggle to comply with the MiCA regulation, Ethena has focused on an “on-chain” approach combined with integrations into large centralized platforms.

Although there is still a long way to go to challenge giants like USDT and USDC, Ethena has shown that innovation can open new opportunities. With a changing regulatory landscape and evolving industry dynamics, 2025 could bring even more competition and surprises in the stablecoin space.