Comparing Sushiswap vs Uniswap

The main feature of Uniswap lies in its unique way of solving the liquidity problem. Uniswap DEX uses special automated liquidity protocols that encourage traders to supply liquidity to the platform. In return, Uniswap provides them with tokens that form a fund and can be used to transact on the platform. Creating a common fund makes trading more convenient and allows users not to look for a buyer to sell.

SushiSwap was created from the Uniswap codebase. However, the DEX team has made significant changes to improve functionality and trading on the DEX. The main feature of the platform was the SUSHI token, which provided users with unique tools for generating additional income and the right to participate in the future DEX.

Photo: Shrimpy.academy

However, it’s undeniable that Sushi Swap’s success is due to Uniswap. The protocol is used to leverage Uniswap’s liquidity. The ecosystem works in two stages. First, traders invest tokens in liquidity pools from Uniswap, and in return, they receive SUSHI tokens. After that, traders transfer tokens and use them on the SushiSwap decentralized exchange (DEX). But SushiSwap developed and integrated a lot of functions so let’s try to compare Uniswap vs SushiSwap.

Beyond the DEX opportunities

Uniswap is a more conservative platform and focuses on DEX features. SushiSwap is expanding into other DeFi sectors and provides a “BentoBox” feature. It is a token store for decentralized applications (DApps). After placing the tokens in the wallet, they are used for major trading and lending.

Liquidity mining

Uniswap DEX is temporarily not mining liquidity. Instead, there is a token reward system. However, a DEX spokesperson said that pool liquidity mining would be resumed soon. At the same time, SushiSwap continues to generate liquidity online by earning tokens that are placed in pools to create liquidity. Uniswap has “concentrated liquidity”, which is provided by liquidity providers by concentrating their tokens in certain price ranges. SushiSwap does not have this feature and has not announced any plans to implement it.

Commission

Uniswap offers three commission levels: 0.05%, 0.3% and 1%. Fee levels depend on what liquidity providers will demand based on the likely volatility of their pools.

DEX Uniswap distributes all costs proportionally among all active market makers (liquidity providers). Also, Uniswap charges 0.30% as a trading fee, which is sent to the general liquidity pool. Thus, traders give part of the funds to the general fund, which allows them to make the necessary transactions at any time. Uniswap provides a smoother and more profitable exchange than Sushiswap. SushiSwap fees charge a single flat of 0.3% on all users. Token holders receive 0.05% fees and liquidity providers receive 0.25%.

What is a Decentralized Exchange and how do they work?

First of all, we need to understand what is DEX? A decentralized exchange or DEX is a trading platform where financial transactions take place directly between traders, without intermediaries. A decentralized exchange allows you to carry out financial transactions without the intermediary services of banks or brokers.

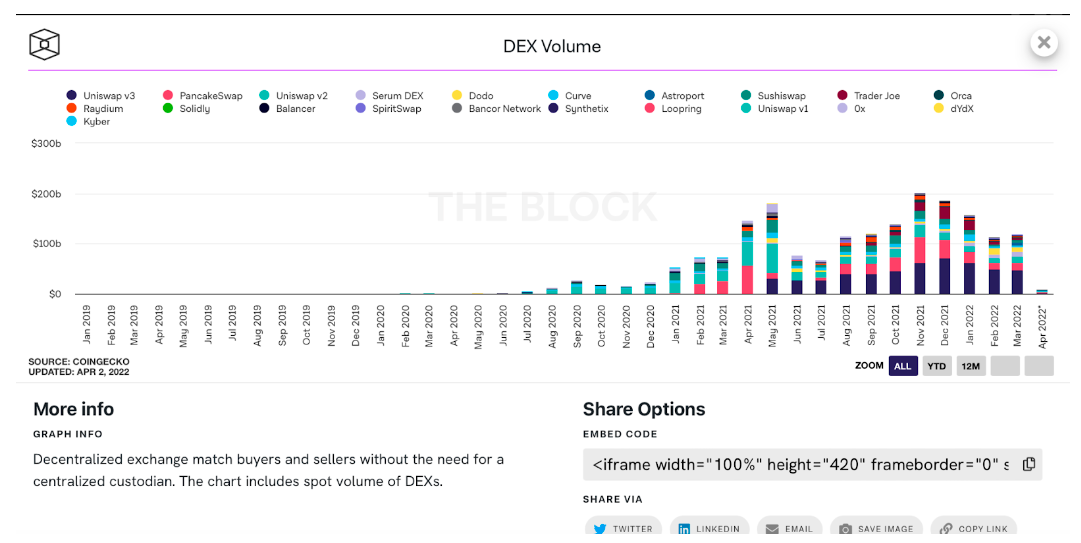

In 2022, the most popular DEXs are Uniswap and Sushiswap based on the Ethereum blockchain. Crypto exchanges provide a wide range of financial services and complete management of your crypto wallet. In March 2022, total trading volumes on the DEX reached $119 billion, according to The Block.

The main feature of DEX from centralized exchanges is exclusively cryptocurrency exchange. On a decentralized exchange, users cannot exchange cryptocurrencies for fiat money like USD and EUR. In addition, it is not possible to use all the functionality on margin trading on DEX, which is a disadvantage of DEX compared to CEX. More information about the latest important developments in the decentralized finance market in detail Trade Crypto.

In other words, decentralized exchanges function through a set of smart contracts. Smart contracts set prices for various cryptocurrencies at the time of the transaction to avoid spikes in volatility. All operations on the DEX are carried out using algorithmic liquidity pools. With their help, investors block funds and receive rewards.

Photo: CoinGeek

And of course, all DEX calculations are recorded directly on the blockchain. If we are talking about Uniswap and Sushiswap, then all transactions will be stored in the Ethereum blockchain. Beyond that, DEXs are very democratic open-source platforms. Developers can use it to create more competitive products like Sushiswap and Pancakeswap.

What is Uniswap?

Uniswap is one of the most popular decentralized crypto exchanges based on the Ethereum blockchain. The main feature of Uniswap DEX is the unlimited ability to exchange tokens without paying commissions.

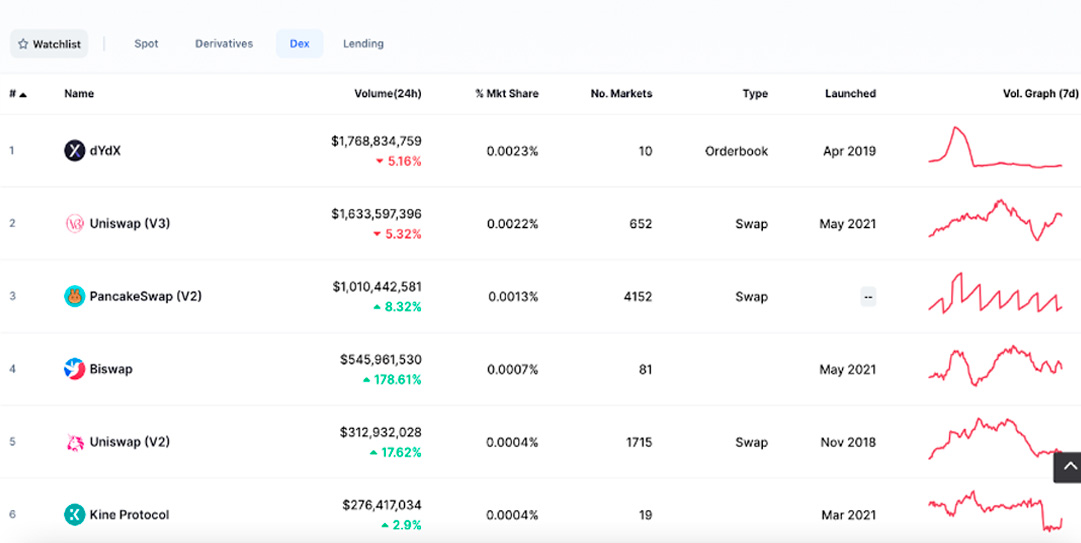

The project was launched in 2018 and by 2022 Uniswap has become the second DEX by total capitalization, according to Coinmarketcap data. In 2022, Uniswap is actively interacting with MetaMask and MyEtherWallet cryptocurrency wallets. DEX is also compatible with all ERC-20 tokens. Thanks to this, users have unlimited opportunities for the free placement of tokens without subsequent commissions.

Cryptocurrency exchange Uniswap has its own UNI token. The DEX token gives cryptocurrency investors the right to participate in the governance and decision-making regarding the future of Uniswap. In addition, the decentralized exchange stores all transaction information directly on the Ethereum blockchain. This avoids the participation of banking institutions in the implementation of transactions.

What is Sushiswap, and how is it different from Uniswap?

SushiSwap is a decentralized cryptocurrency platform that uses smart contracts to carry out transactions. Some users provide tokens through liquidity pools, due to which trading takes place. Other users lock their funds in these pools in pairs of tokens to be able to complete the exchange. As a result, these users receive a certain income in the form of a percentage of the payment received as a result of the transaction.

In addition to Token Swaps, SushiSwap DEX provides SUSHI coin staking and reward services. SushiSwap also provides an opportunity to participate in lending services and invest in proposed startups through MISO’s service.

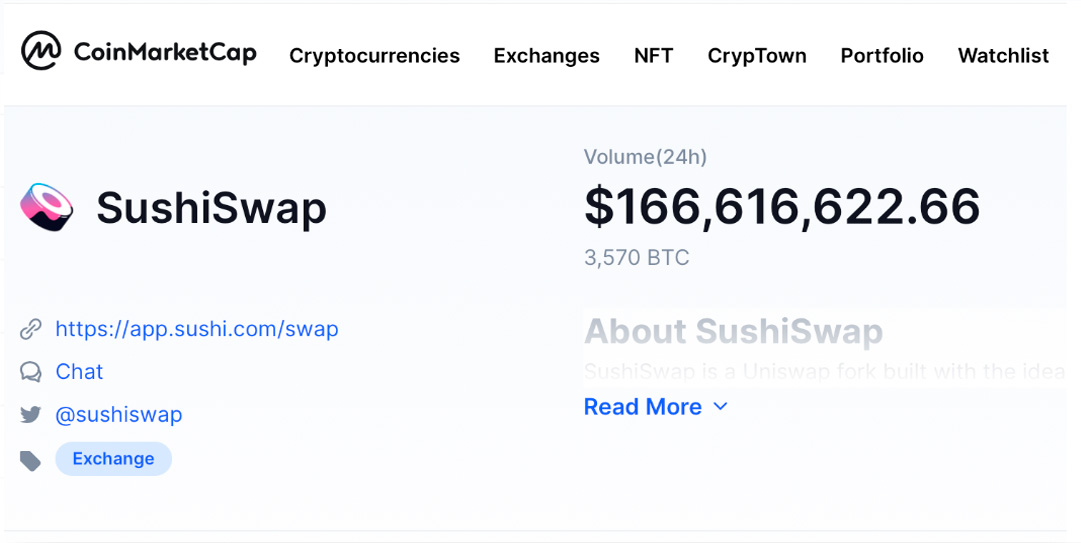

Photo: coinmarketcap

SushiSwap also has its Sushi token. It is also an ERC-20 token that is distributed among the platform’s liquidity providers through Liquidity Mining. The maximum amount of SUSHI tokens is $250 million. The block mining rate determines the Sushi supply.

The main difference from Uniswap is that Sushi Swap has transformed into a decentralized community, with a token holder management system. SushiSwap have set their sights on features focused on the community and investors.

Which DEX is better, Sushiswap or Uniswap?

Summing up, it must be said that initially Uniswap was the platform of the future in the DeFi market. The unique liquidity supply system and the participation of investors in the life of the platform were highly appreciated by the crypto community.

However, subsequently, the “child” of Uniswap largely surpassed its “parent”. The functionality that SushiSwap provides is much wider in 2022. The project chose the path of comprehensive development and modernization of existing mechanics, which were taken from UniSwap.

Users are becoming more open to new features, capabilities and technologies. The SushiSwap team understands this and tries to combine the best components of an existing protocol with novelties that go beyond DEX. At the same time, Uniswap continues to stand still without real valuable updates, but only to launch such ones in the future. So in this fight SushiSwap vs Uniswap the Sushi has the advantage.

Press releases or guest posts published by Wealth Growth Insights have sent by companies or their representatives. Wealth Growth Insights is not part of any of these agencies, projects or platforms. At Wealth Growth Insights we do not give investment advice and encourage our readers to do their own research.